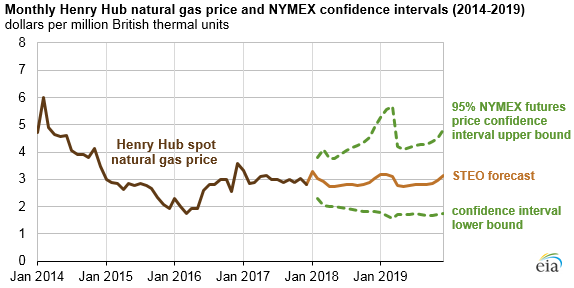

The confidence interval range for natural gas prices shown in the figure above is a market-derived range that reflects trading in New York Mercantile Exchange (NYMEX) futures and options markets and is not directly dependent on EIA's supply and demand estimates. The values for the upper confidence interval increase during the winter months compared with the rest of the year, reflecting the higher probability of an increase in natural gas consumption for space heating as a result of colder weather.

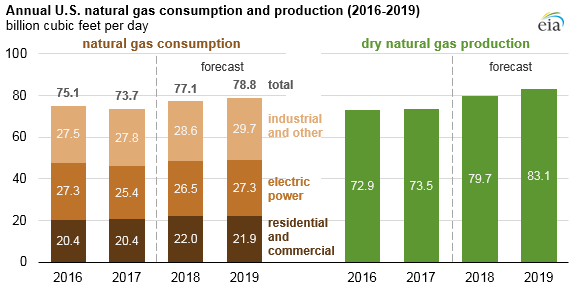

In 2018, the STEO forecasts increasing use of natural gas for electric power generation because of low natural gas prices. Natural gas-fired power generation is also expected to increase in 2019 because of growth in total electricity generation—fueled in part by increased natural gas-fired capacity—and anticipated coal-fired retirements.

Increasing pipeline takeaway capacity out of the Appalachia region, expected to increase by 8.4 Bcf/d by spring 2018, will deliver natural gas to end-use markets. Greater pipeline connectivity reduces spot market discounts to Henry Hub, the main price benchmark for natural gas, and is expected to result in higher wellhead natural gas prices and production growth.

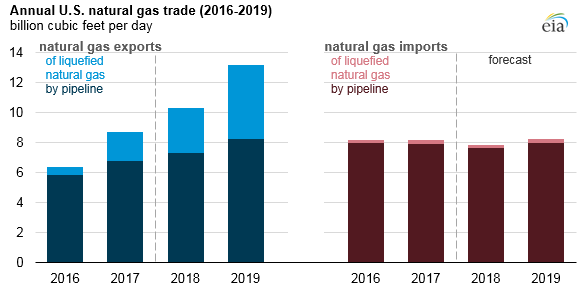

Most of the projected increase in U.S. natural gas exports is expected to come from exports of liquefied natural gas (LNG). EIA expects gross exports of LNG to average 3.0 Bcf/d in 2018 and 4.8 Bcf/d in 2019, up from 1.9 Bcf/d in 2017, as new export terminals in Maryland, Georgia, Texas, and Louisiana come online. Exports of natural gas by pipeline to Mexico are expected to increase by 0.6 Bcf/d and 0.8 Bcf/d in 2018 and 2019, respectively, with total pipeline exports averaging 8 Bcf/d in 2019. By 2019, exports of natural gas by pipeline slightly exceed imports of natural gas by pipeline.

Principal contributors: Kristen Tsai, Naser Ameen